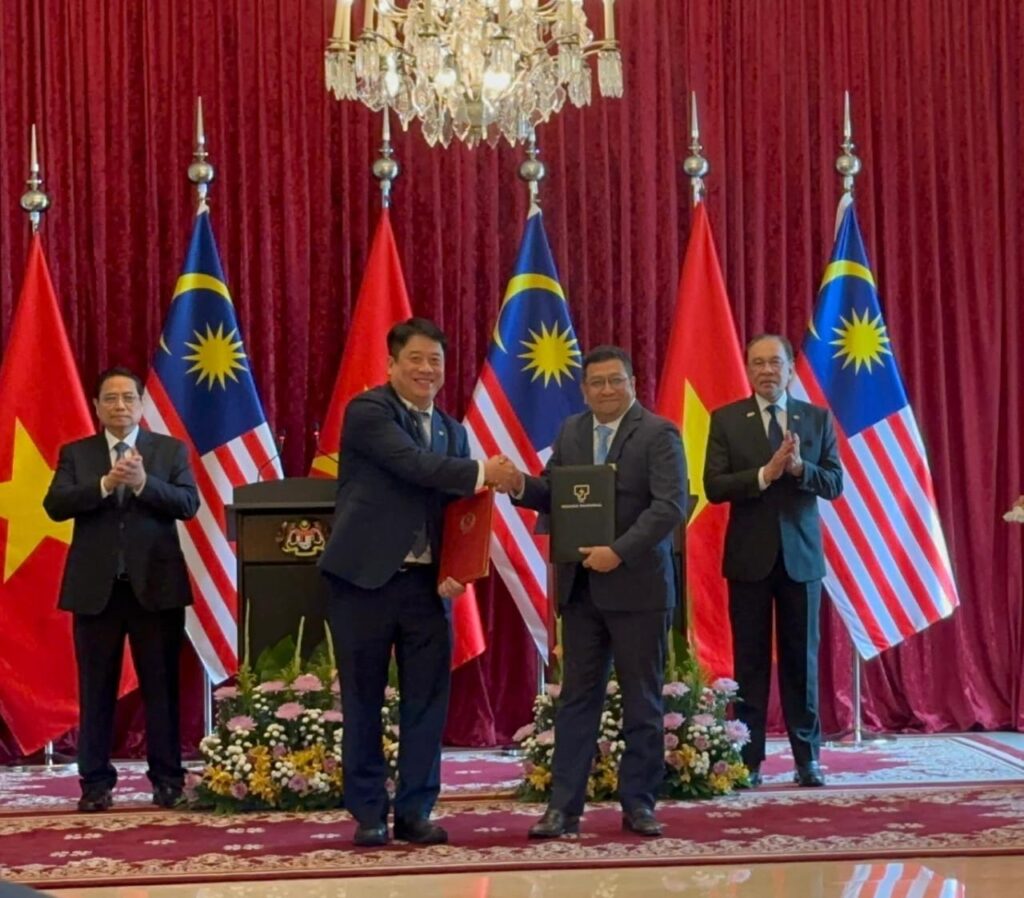

The project aims to land 2,000 MW in Malaysia by 2034, of which 700 MW will power Malaysia and 1,300 MW will be wheeled to Singapore. TNB will reinforce its grid and build the IMalaysia-Singapore interconnection, creating a regional green energy corridor.

Backed by the Malaysian Prime Minister, Project RISE will be executed in phases, starting with a consortium-led Joint Development Agreement by May 2025. A second phase—via land—may follow post-2035.

RISE reflects Malaysia Inc.’s ambition to become ASEAN’s renewable energy hub, advancing energy security and climate action through smart interconnection.”

Towards climate neutrality and sustainability leadership

Antonio A. Ver, November 3, 2022, Revised October 3, 2023,Fort Bonifacio, Metro Manila, Philippines.

“Wind power, nuclear power, hydro power, ocean power, solar power, and geothermal are the energy sources with the lowest life-cycle emissions, which include deployment and operations.” (Wikipedia).

Situationer:

The Independent Electricity Market Operator of the Philippines (IEMOP) on October 18, 2022, reported the average electricity market price in September for Luzon and Visayas at Php12 per kilowatt hour (kWh) as compared to the previous month’s Php7.26/kWh.

After accounting for all bilateral and spot market transactions, the effective settlement price for September stood at Php9.16/kWh, the highest for the year.

During an online briefing, officials said average demand rose by 1.47 percent or 154 megawatts (MW) to 10,639 MW, while average supply was reduced by 4.73 percent or 675 MW to 13,599MW due to generator outages. (October 24, 2022).

In September, the National Grid Corporation of the Philippines declared the Luzon grid under red alert status due to major generation inadequacy. A total of 3,401MW were on unplanned outage, and three generating units had a total deration of 226MW. Derated plants are those that are not operating at full capacity.

Thus, total generation from diesel plants accounted for 220 gigawatt hours (GWh), or 2.9 percent of the generation mix, compared to the production of 93 GWh last August.

For coal power plants, the contribution for September was 4,434 GWh (57.6 percent), natural gas at 1,407 GWh (18.3 percent), geothermal at 772 GWh (10 percent), hydro plants at 582 GWh (7.6 percent), variable renewable energy resources (solar and wind) at 172 GWh (2.8 percent), biomass plants at 67 GWh (0.9 percent), and battery energy storage systems at 2 GWh (0.03 percent).” (Energy News, October 24, 2022).

In sum, 60% coal is bad for the environment. Despite the promotion of coal as “fuel of choice” and Clean Coal Technologies (CCT) to support medium to heavy industries, economic growth has been sluggish. Worse, the “Philippines power sector is already at full market price with no subsidies.”

Where do we go?

We aggressively push renewables, mainly solar and tidal power. More than engineering and environment, within business paradigms and models, innovation and technologies must be percolated through incubation where the modus vivendi is building an overarch. This has been my mantra since the late 80’s.

Natural gas takes over. However, combustion needs to be mitigated. Can we build 1,800 MW of CCGT baseload power plants from 2022 to 2037? What are the objectives for FSRU and fuel distribution?

How about investing globally?

A very large regional power player “is modifying its current policy to invest only with very large investment funds or large utilities.”

Energies Global Finance positions a Wealth Management Fund to co-invest in the United Kingdom and EU.

We will go to the Gulf Cooperation Council. We will plant a seed in the United Arab Emirates, the fastest growing RE economy in the Gulf.

The rudiments of the strategy are anchored on creativity in finance and behavioural economics. Permitting and compliance must be sifted. We must know how monies work. We must anticipate how people act and decide on spending.

Malaysian Tariff in ASEAN Context and Investment Atmosphere